No products added!

September 11, 2025

Posts

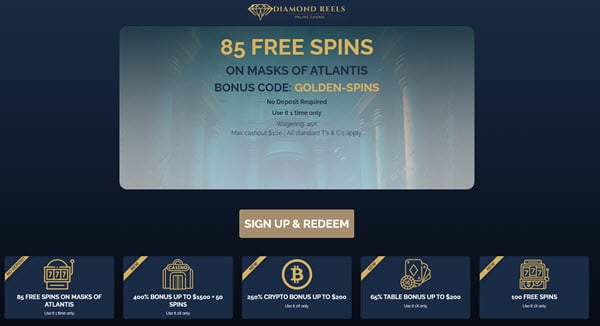

Normally, this is based in the chief selection otherwise less than a keen solution labeled “Deposit” or “Cellular Deposit.” Banking institutions have a tendency to highlight this particular see site feature within application interfaces making they accessible. Of many mobile percentage workers including Apple Shell out work by tying a bank account or card, whereby the fresh money are created. Here, we’ll speak about just how mobile view deposit functions, a few of the potential benefits of using it, and you may suggestions to consider just before depositing a check on the web. When you are keen on on-line casino incentives, then you’ll end up being pleased to remember that of many shell out-by-mobile phone gambling enterprises give her or him included in the promotion packages.

See site: Exactly what inspections commonly eligible for cellular put?

- With a mobile financial software, you could potentially manage your profit from your own mobile phone without the need to sit from the a pc otherwise visit a branch of your own lender.

- Attempt to look at your banking arrangement on the direct sort of monitors the establishment often approve to possess mobile put.

- If your banking app crashes whilst you’re and make in initial deposit, be sure to features a reliable web connection.

- The newest cellular application makes an electronic digital picture of the new consider, that’s then canned because of the financial for put.

- Regrettably, TD Financial’s mobile take a look at deposit restrictions will vary by membership and you will customers.

- It’s a smart idea to hold they for a few away from weeks, and if one thing has to be affirmed.

Deposits generated immediately after 10pm ET was reported to be made on the next working day. Money placed is almost certainly not instantaneously designed for detachment and can be made available based on the Fund Access section of the Laws to own Individual Put Profile. Cellular financial is really as safe while the financial individually since the much time as you capture procedures to keep your information that is personal to your your own unit safe. But before you indication the fresh consider and ready yourself to take photographs on the cellular app, make sure that your look at is made over to you truthfully.

- Typical have fun with will help you become more at ease with the process and you can improve your financial feel.

- If the take a look at visualize isn’t best (too ebony, fuzzy, or forgotten sides), the new app you are going to refute they.

- All cellular financial institutions try kind of digital banking companies, but not the digital banks is actually cellular-concentrated.

- Keep reading to know simple tips to precisely promote a to possess cellular put.

- The fastest look at put approach depends on their bank, but a mobile look at put usually takes around eventually expanded so you can processes than a call at-individual or Atm put.

That it easier way of cellular depositing monitors is normal certainly numerous significant banking institutions, as well as those individuals you already lender at the. For those who’ve never used the cellular consider deposit ability or simply just require to find out what your every day and you will month-to-month restrictions is, you’ve come to the right spot. If the request is actually rejected or if you’re however unhappy together with your restriction, you can look at beginning a primary otherwise Prominent Bank account, for those who wear’t currently have one to. You may have the option to invest a payment for their financing as available a comparable and/or next day.

Evaluating Option Put Alternatives at the Casinos to pay by Cellular Bill

Users will help that with strong passwords and multi-factor verification. Cellular put will be different their take a look at put experience to the greatest, but there are many stuff you should become aware of. To have a much better experience, install the newest Pursue application for your new iphone 4 or Android os. In the event the a check is established over to your company rather than your identity, you might endorse the brand new review account of the team. You’ll must make the name of your organization and your organization identity on the back of the view, and then sign the term. Immediately after endorsing your own look at, you’ll need to take pictures of your own look at and you can submit him or her on the lender.

Most banking companies don’t let one deposit bucks utilizing the mobile application. Yes, most financial institutions allow you to deposit 3rd-group checks by using the cellular put ability. Manage track of monitors that you’ve placed through cellular financial. This can help you tune your financial transactions better.

Because the monetary technology evolves, banking institutions, credit unions and other loan providers discovered a method to make on line financial and you may digital money management more convenient for users. Cellular banking software—including the Money You to definitely Mobile software—enable you to take a look at membership balance and you can import funds from their cellular tool. And you will actually put paper inspections out of about anywhere using your mobile or tablet. Inside the today’s electronic many years, depositing inspections has become more convenient than in the past, because of the advancement of cellular financial technologies. Not any longer would you like to individually check out a lender branch or an atm to put monitors; instead, you’ll be able to exercise from the comfort of your home with your portable.

If you are using your financial organization’s formal software, all financial info is safely encrypted. Yours info is became an enthusiastic unreadable code because is sent for the financial institution digitally. Debt establishment uses unique information, for example a code, to de-code all the details and you will deposit your own cheque properly. First, there is a limit of $dos,500 to own an individual view and you may $cuatro,000 for a business go out. There is a running 3-day restriction from $10,100 that have a five (5) look at restrict at that time.

Financial institutions have finance access formula one regulate how a lot of time it requires to possess a to clear. Particular banking companies, such, could make part of the take a look at readily available right away, with the rest available another working day. Along with her, such steps will help boost defense while using the your own mobile device to help you deposit checks, opinion the stability otherwise create other on the web banking points. Please note that the kind of checks which might be accepted because of Mobile Consider Put is generally amended or limited when. To learn more, excite make reference to the newest Digital Financial Contract for Business online and you may Cellular Banking. Checks deposited playing with Cellular Consider Deposit might possibly be obtainable in conformity to the Fund Availability Coverage revealed within Company Put Membership Contract.

What do you do having a just after cellular deposit?

Although not, banking companies features recently caused it to be simpler to put monitors during your mobile phone without having to step feet outside your residence. Observe how with ease you could put a check right from their portable — quickly, easily, with mobile put in our cellular banking app. There are many different benefits of using cellular consider deposit, along with a leading amount of convenience and you will a reduction in date driving and wishing in-line. Seacoast Lender provides the subsequent capacity for fast access so you can financing deposited from another location. Some other benefit are security, because the cellular put almost eliminates danger of a being lost or stolen.