No products added!

October 15, 2025

Articles

With a $step 1 put, the advantage would be smaller— as an example, a one hundred% fits will give you just $step one additional. Don’t assume all step 1 dollar deposit added bonus is the identical, as they possibly can have differing terms and conditions. Discover the offer you like probably the most before making a decision for the an online gambling establishment. Ruby Luck is a gambling establishment revealed within the 2003 with a properly-organized web site and you will associate-amicable apps. Yet, it series up all of our finest $step 1 deposit gambling enterprise checklist for its good bonus render and you will crypto help. Now, the new 200x betting importance of the fresh product sales wasn’t the easiest to accomplish.

$10 put casinos

For individuals who go back to your own tax family of a temporary assignment in your months out of, your aren’t experienced on the go when you are in your hometown. You might’t deduct the cost of meals and you can rooms truth be told there. Although not, you can subtract your take a trip expenditures, in addition to foods and hotels, whilst travelling amongst the temporary work environment along with your taxation home. You might allege this type of expenditures as much as the total amount it could have ask you for to stay at the brief place of work. Over the past 5 years, Davida features centered the woman referring to betting, specifically web based poker.

Pay from the View otherwise Money Buy Using the Projected Tax Commission Coupon

The standard buffet allowance is actually for the full twenty-four-time day’s travel. For those who travelling to have element of twenty four hours, for example to your weeks your leave and you may return, you should prorate a full-time M&Web browser rates. Which code in addition to enforce should your company uses the typical government per diem price and/or highest-low rate. To have travel inside the 2024, the speed for some small localities in america is $59 daily.

For many who found a check for a refund your aren’t eligible to, and for an enthusiastic overpayment that should was credited to projected income tax, never dollars the newest look at. Do not consult in initial deposit of any part of the refund to a merchant account this is simply not on the label. Don’t allow their tax preparer in order to deposit any element of their refund for the preparer’s membership. How many direct dumps to one account otherwise prepaid service debit cards is limited to three refunds per year. After that restriction is actually exceeded, paper monitors would be delivered rather. It financing assists pay money for Presidential election campaigns.

Such, when the an on-line sportsbook has to offer a a hundred% earliest put extra all the way to $100, participants should very first put an entire $a hundred to make the largest extra it is possible to. The new acceptance incentive in the Parlay https://mrbetlogin.com/baccarat-pro-series/ Gamble are a form of basic-put incentive. Parlay Gamble often borrowing from the bank the new players a good 100% deposit match bonus as high as $one hundred. These types of incentive fund can then be employed to go into any one of the brand new tournaments offered through this program.

You include in income precisely the number you can get one’s more than your real expenditures. You’ve got acquired an application W-2G, Particular Playing Profits, showing the degree of their gaming winnings and one income tax taken from them. Range from the number from package step one for the Agenda 1 (Setting 1040), range 8b.

- The newest interpreter’s functions are utilized only for work.

- In the event the value of disregard the increases, you have made an income.

- A typical example of this type of pastime are a hobby or a ranch you work generally to have athletics and you can fulfillment.

- And then make this program, complete Mode W-4V, Voluntary Withholding Request, and present it to your using office.

Your own representative to have a great decedent changes out of a mutual return select from the surviving mate to help you another return to have the newest decedent. The private affiliate features one year regarding the deadline (as well as extensions) of one’s go back to improve change. 559 for more information on submitting money to have an excellent decedent. If you remarried until the avoid of your own income tax 12 months, you might file a shared get back together with your the newest partner. Their deceased spouse’s filing reputation are married filing on their own for that year. You might have to shell out a penalty for those who document a keen incorrect allege to have refund or borrowing.

- The newest fifty% restriction tend to implement immediately after determining the amount that would otherwise meet the requirements to own a deduction.

- We do have the address with your constantly updated list of the fresh no deposit gambling enterprises and bonuses.

- Such numbers are usually utilized in money on your own go back to possess the season you translated him or her out of a timeless IRA so you can a good Roth IRA.

- The new T&Cs during the $step 1 deposit casinos could appear complicated because of the pure level of information.

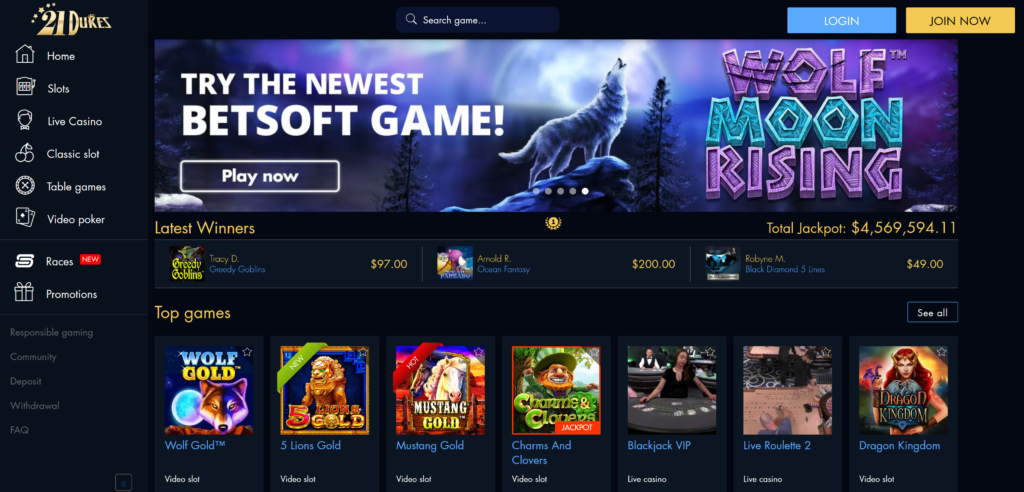

Here, we’ll make it easier to find the right one dollar lowest put casinos to match your play design and you will extend their bankroll. The internet casinos provide incentives and you can promotions which can be stated that have a great $step one put. Dollars bonuses are unusual, but casino credit, added bonus gamble and you will incentive revolves is actually awarded to help you the brand new and you can going back participants. Bonus revolves could be linked with a limited level of video game or just one position sometimes.

A charge-base state official drives ten,000 kilometers throughout the 2024 to have team. Lower than their employer’s guilty plan, it take into account enough time (dates), place, and you may company intent behind for every excursion. Its boss will pay them a mileage allowance away from 40 dollars ($0.40) a distance.

The new Service out of Protection establishes for each and every diem rates for Alaska, Their state, Puerto Rico, American Samoa, Guam, Midway, the brand new North Mariana Isles, the new U.S. Virgin Countries, Wake Isle, or other non-overseas parts outside the continental United states. The new Service of State sets for each diem prices for all almost every other overseas section. A bona-fide company mission can be obtained if you possibly could prove an excellent real company objective for the private’s exposure. Incidental functions, including typing cards or assisting in the funny users, aren’t adequate to make the expenditures allowable. Such, you should spend some your costs if the a resorts boasts one to or more dishes within the place costs.

But not, contributions generated because of an adaptable spending otherwise comparable arrangement provided by your boss should be found in your income. So it number was stated since the earnings in shape W-2, field 1. To figure their show of your own taxation on the shared return, basic contour the brand new income tax your spouse might have paid got you submitted independent efficiency to have 2024 using the same filing reputation in terms of 2025. Then, proliferate the brand new tax to the shared return by the after the fraction.